USTMAAA Foundation

Stocks, securities, and mutual funds

Donate stock, securities, or mutual funds and potentially receive

tax deductions while avoiding capital gains taxes.

About gifts of stocks, securities & mutual funds

-

Giving appreciated assets such as stocks, securities, and mutual funds can help you avoid paying capital gains taxes. And if you've had the assets for more than one year, you can also receive an income tax deduction.

-

Give appreciated assets now and enjoy the benefits, or add us as a beneficiary of these assets and eliminate estate and inheritance tax, making the most of your gift.

Benefits

-

Gifts of assets can often save you far more on taxes than gifts of cash.

-

Avoid all capital gains taxes.

-

Receive an income tax deduction for the value of the assets (if you’ve had them for more than a year).

-

Make an immediate impact in the Philippines.

How it works

-

Transfer appreciated securities directly to USTMAAA Foundation to avoid capital gains taxes.

-

Receive a tax receipt for the value of the assets.

-

The securities are sold and the funds are immediately put to use for the greatest impact.

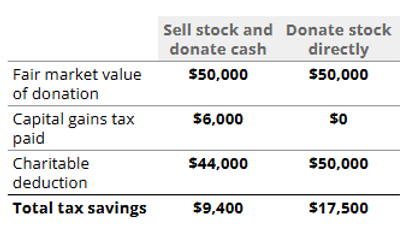

Benefits of donating stock directly

vs. selling and then donating cash

Bottom Line

-

You reduce your taxes by an extra $8,100 and USTMAAA Foundation receives an additional $6,000.

-

By donating the stock directly, you avoid paying the capital gains tax and can deduct the full market value of the stock, resulting in higher total tax savings.

Assume:

-

Stock purchase price (cost basis): $20,000

-

Stock value at donation: $50,000

-

Capital gains: $30,000

-

Assumed long-term capital gains tax rate: 20%

-

Assume ordinary income tax rate: 35%

-

Donor itemizes deductions

Illustration:

Donor-advised funds

Easily recommend grants to for tax-efficient giving.

About gifts of donor-advised funds

-

A donor-advised fund (DAF) allows individuals to make charitable contributions and receive an immediate tax deduction. The funds are managed by a DAF custodian and the donor can recommend grants to their preferred nonprofit organizations.

-

Donors can contribute to the fund over time and recommend grants to charities at their discretion, providing flexibility in their giving strategy.

Benefits

-

Retain the flexibility to make grant recommendations over time.

-

Receive an immediate tax deduction when contributing to your fund.

-

Make an immediate impact in the Philippines.

How it works

-

Prepare your grant request by providing the necessary information about USTMAAA Foundation to your donor-advised fund (DAF) provider.

-

Submit the grant request, specifying the amount you wish to donate and any additional details.

-

Once approved, your DAF provider distributes the funds to USTMAAA Foundation on your behalf.

Qualified charitable distributions from an IRA

Give tax-free gifts from your IRA that benefit our mission and you.

About gifts of qualified charitable distributions

-

A qualified charitable distribution (QCD) is a tax-efficient way for individuals who are age 70 ½ or older to make gifts directly from their individual retirement account (IRA).

-

QCDs can count towards satisfying an individual's required minimum distribution (RMD) for the year, which is the minimum amount that an individual must withdraw from their IRA each year once they reach age 73.

Benefits

-

Reduce taxable income.

-

Counts towards your required minimum distribution for the year.

-

Make an immediate impact in the Philippines.

How it works

-

Make an immediate impact in the Philippines.

-

Enjoy the benefit of a tax-free distribution from your IRA, contributing towards your required minimum distribution for the year.

-

Potentially reduce tax liability by excluding the distribution amount from taxable income.

Charitable gift annuities,

remainder trusts, and lead trusts

Learn about gifts that allow you to transform assets into a meaningful legacy while supporting yourself or your loved ones for years to come.

Charitable lead trusts

A gift that makes payments to charity for a set number of years, after which the remaining assets return to you or your loved ones. This type of trust allows you to make significant gifts to charity for a period of time, while still planning for the eventual transfer of wealth to your family.

Cryptocurrency

Donate bitcoin, erthereum, and othes to save on taxes and make a big impact.

About gifts of cryptocurrency

Donating cryptocurrency directly is a fast and secure way to make a tax-smart charitable contribution.

Benefits

-

Potentially receive a federal income tax deduction equal to the full fair market value.

-

Avoid paying capital gains tax on an appreciated asset.

-

Make an immediate impact in the Philippines.

How it works

Donate cryptocurrency directly to USTMAAA Foundation and we’ll immediately convert your coins into fiat. Your gift will fund our projects and/or endowment.

Real estate

Donate real estate to make a lasting impact,

unlocking the hidden potential of your property's value.

About gifts of real estate

-

Making a gift of real estate may be an appealing option for property owners with appreciated value, as it helps avoid capital gains tax liabilities.

-

Additionally, it benefits individuals seeking to simplify estate planning, reduce estate tax liability, and relieve themselves from ownership expenses and maintenance burdens.

Benefits

-

Eliminate ownership and maintenance expenses.

-

Create a lasting legacy in the Philippines.

How it works

-

Contact us to let us know about your interest in donating real estate. Gifts of real estate are nuanced and require a discussion so we can learn more about your property and intent.

-

Obtain an appraisal of the property to determine its fair market value. This will help you determine the amount of your charitable deduction for tax purposes.

-

Work with us and your attorney to transfer the property ownership. This may involve executing a deed, transferring a title, and completing any necessary legal or regulatory requirements.

-

Claim your charitable deduction on your tax return for the year in which the donation is made, while avoiding income tax on any appreciation in value. If the contribution exceeds limits based on your adjusted gross income (AGI), you may be able to deduct the excess over the next five years.

-

Consult a qualified estate planning attorney and/or a financial advisor to determine if this option is right for you.